Simple and Competitive Tax System

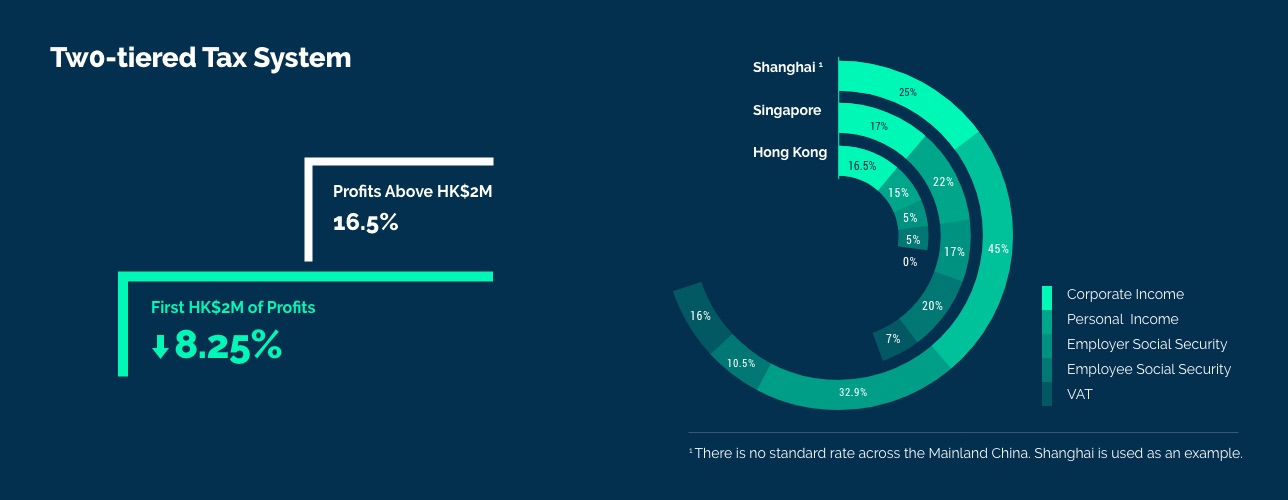

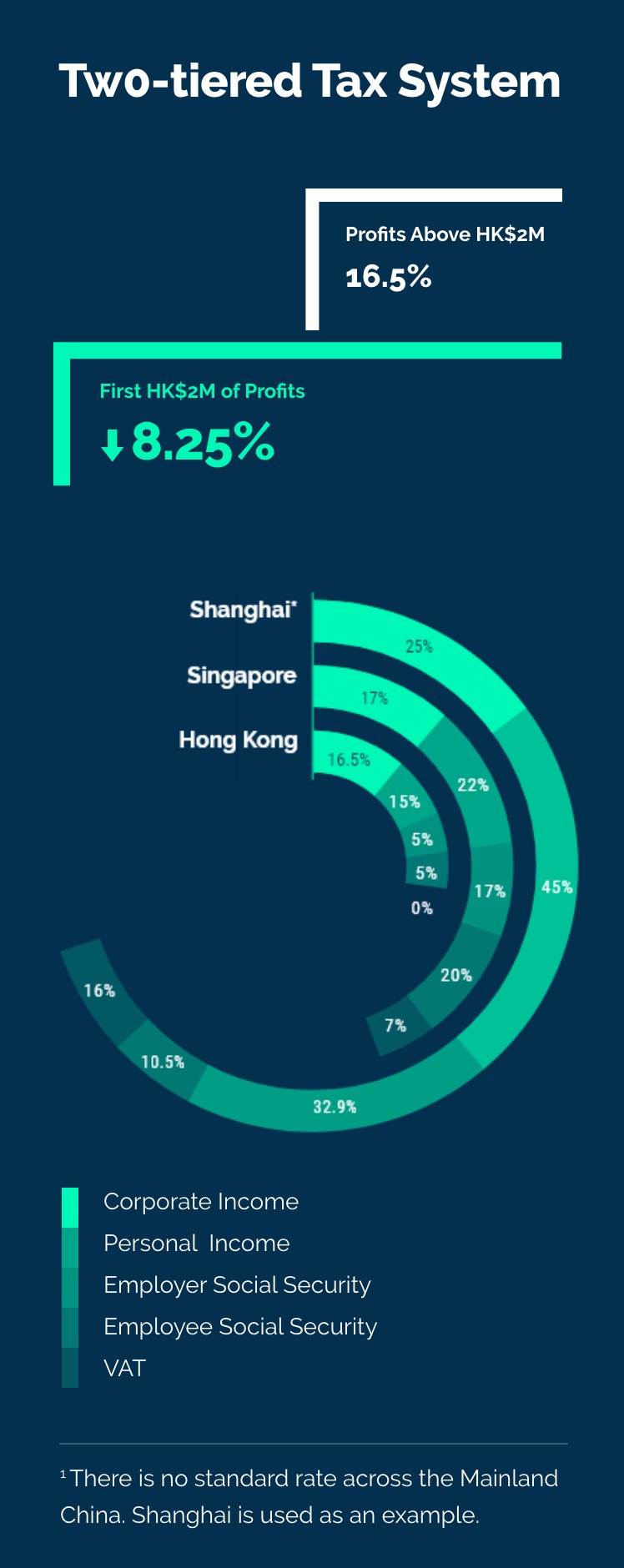

Hong Kong's business-friendly tax system is a signature of operating in the city. Simple and low, the system features a two-tiered corporate tax rate – 8.25% for the first HK$2mn of profits, and 16.5% for profits above that – with standardised salary and property taxes of 15%. And that's it!

Features

NO Extra Tax

- VAT/GST/Sales tax

- Capital Gains tax

- Withholding tax on investments

- Estate duty

- Global taxation

- Wine duty

Comprehensive Double Taxation Agreements

Hong Kong has signed Comprehensive Double Taxation Agreements (CDTAs) with 43 jurisdictions.

(as of Aug 2020)

Negotiations

Negotiations with 14 more jurisdictions are in progress.

(as of Aug 2020)