Welcome to Hong Kong FinTech Week!

“Hong Kong is open and inclusive towards the global community of innovators engaging in virtual asset businesses”

“Hong Kong is open and inclusive towards the global community of innovators engaging in virtual asset businesses”

Opening Remarks by Paul Chan, Financial Secretary, Hong Kong SAR

Hong Kong’s Financial Secretary Paul Chan kicked-off Hong Kong FinTech Week with his opening speech. He remarked that five years ago, the city had no more than 180 fintech companies, but today, there are over 800, ranging from startups to large enterprises.

He credited the growth to Hong Kong’s open market, a rigorous regulatory regime, the rule of law, sophisticated infrastructure, and the free flow of capital and information. Mr. Chan also signalled that Hong Kong is open and inclusive towards the global community of innovators engaging in virtual asset businesses.

He added that “The government, in conjunction with the financial regulators, are working towards providing a facilitating environment for promoting sustainable and responsible development of the virtual asset sector in Hong Kong.”

Click here to watch the playback.

Highlights of the Day

Policy Statement on Development of Virtual Assets in Hong Kong

By the Financial Services and the Treasury Bureau

A policy statement on the development of Virtual Assets (“VA”) in Hong Kong was announced this morning by the Hong Kong Government. The statement issued by the Financial Services and the Treasury Bureau (“FSTB”) sets out the Government’s policy stance and approach towards developing a vibrant sector and ecosystem for VA in Hong Kong.

Among the key topics covered under the policy statement is regulation, in which the SFC will conduct a public consultation on how retail investors may be given a suitable degree of access to VA, and Hong Kong will be open to the possibility of having Exchange Traded Funds (“ETFs”) on VA in our market.

The Government is open to future review on property rights for tokenised assets and the legality of smart contracts, so as to facilitate their development in Hong Kong.

Full details can be found here.

“Part of this dynamism comes from the fast-growing ecosystem in Hong Kong.”

“Part of this dynamism comes from the fast-growing ecosystem in Hong Kong.”

Opening Keynote by Eddie Yu, Chief Executive, Hong Kong Monetary Authority

Entering the stage in style as an avatar, the HKMA’s Yu expressed his eagerness to explore how the Metaverse will shape a new landscape for real-world financial activity in the future. He also shared three major takeaways from his fintech journey thus far:

- Radical Open-mindedness - The need to be radically open to new ideas and try things that could make the financial system better. This mindset has spurred Hong Kong to develop its popular Faster Payment System (FPS), establish eight virtual banks, and support more advanced data infrastructures in the financial system.

- More Is More - New platforms in retail payment, data infrastructures, and cross-border payment platforms tend to be more successful and sustainable when they achieve widespread adoption, leading to a strong network effect. In other words, the larger the network, the more the users.

- Beyond Tech - The need to go well beyond technology to create network effects, because adoption could be challenging for projects that seek to replace the current status quo. It takes more than just technological developments to ensure there will be something valuable and attractive for every stakeholder. For instance, commercially viable arrangements were made in the CDI initiative; policy and other business challenges were considered in the Ambridge Cross-border Payment project.

Click here to watch the playback.

Animoca’s Yat Siu: “Web3 changes the relationship from consumer to owner”

Yat Siu, Co-Founder & Executive Chairman, Animoca Brands

– Fireside chat moderated by Christopher Hui, Secretary for

Financial Services and the Treasury, Hong Kong SAR

During his fireside chat, moderator Mr. Hui began by quizzing Mr. Siu, on which of his many businesses was his favourite. Although Mr. Siu declined to pick a winner, he did offer his view on how emerging infrastructure is transforming society.

“In the classic form of capitalism, value typically accrues only to the shareholders. While Hong Kong has obviously flourished in this context, it has been difficult for some to participate. What Web3 does is change the relationship from being a customer/consumer, to a customer/owner who shares in the potential of the business itself.”

“Speed is one of Hong Kong’s special sauces, and technology adoption is rapid. Four years ago, most people in Hong Kong didn't even know what NFTs were, now we have the Hong Kong Government issuing NFTs. It shows there is a real love for this new type of stuff here, and the potential to drive the region.”

Click here to watch the playback.

"Bringing crypto-as-a-service providers into the regulatory fold is the only pathway to embrace innovation.”

Julia Leung, Deputy CEO & Executive Director, Intermediaries,

Securities and Futures Commission

SFC’s Ms. Leung advocated the need for orderly market development in cryptocurrencies to protect the industry and support innovation. “The crypto community has long believed that regulation inhibits innovation, which limits FinTech development and investor choice. But the excesses of certain crypto firms threatened the entire crypto ecosystem and shrunk the capitalisation of crypto assets to US$1 trillion from a peak of US$3 trillion,” said Leung.

She added, “Let me be clear. We support the underlying DLT technology, and we also welcome the growth of the FinTech community in Hong Kong. NFTs, the metaverse and Web 3.0, are beginning to reshape our lives.”

“However, the Crypto winter shows that tapping these opportunities is far from straightforward. In fact they are fraught with risks, which can harm investors and undermine confidence in the space. Bringing crypto-as-a-service providers into the regulatory fold is the only pathway to embrace innovation.”

Click here to watch the playback.

"Privacy protection is one of the issues at the top of the (eCNY) agenda”

Keynote Presentation by Yi Gang, Governor, People's Bank of China

During his presentation, Mr. Yi said that eCNY is China’s Central Bank Digital Currency, and that it is intended to meet domestic payment needs, enable the development of inclusive finance, as well as improve the efficiency of the currency and payment system.

He added the People’s Bank of China (PBoC) restricts eCNY to authorised operators, who collect only the information necessary for their exchange and circulation services. Personal information security is assured through advanced technology and strict management, in full adherence with consumer privacy protection laws and regulations.

Encrypted sensitive information is de-identified to all non-transacting parties. Entities and individuals are prohibited from arbitrary enquiries without legal authorisation. However, Mr. Yi noted that the situation isn’t black and white, and a delicate balance must be struck between protecting privacy and combatting illicit activity.

The PBoC is working with the Hong Kong Monetary Authority and other monetary authorities on CBDC to better serve global and domestic investors and enhance Hong Kong’s role as an international financial centre.

Click here to watch the playback.

Industry Insights

FTX’s SBF: The need for a knowledge-based system over a wealth-based system

Sam Bankman-Fried, Co-Founder & CEO, FTX

Crypto entrepreneur Mr. Bankman-Fried did not pull any punches. He believes that assets and investments should not have wealth-based qualifications, but instead be knowledge-based.

“Wealth-based assets are classist and racist and create massive, inequitable access to digital assets. This allows the rich to get richer.

“We want to make sure that people know what they are accessing, that they know the risks, and can make reasonable judgment calls, so implementing a knowledge-based system to determine access is more effective than a wealth-based system.” he said.

Ant Group: Digital Technology and Opportunities for Hong Kong

Eric Jing, Executive Chairman & CEO, Ant Group

Appearing via video, Mr. Jing noted that Hong Kong has cemented its position as a global hub for trade, logistics and finance, thanks to a global outlook and a leading role in technology. He believes advanced technology can also unleash new growth opportunities for Hong Kong, which is rich in technology and innovation.

He said, “According to research, the Government’s decision to replace traditional stimulus measures during COVID-19 with digital consumption vouchers was at least three times more effective than areas using traditional methods.

“The technology that has redefined consumer markets is now reshaping industrial value chains. And Hong Kong once again stands at the forefront in the digital era.”

New technologies and related solutions can significantly reduce ‘trust costs’ and friction. With smart contracts, information related to procurement is confirmed and executed automatically. Such high degrees of collaboration boost efficiency and reduce errors throughout the entire trade and logistics value chain.”

Central Banks and Innovation: An Evolution or a Revolution?

Cecilia Skingsley, Head of BIS Innovation Hub, Bank for International Settlements

– Fireside chat moderated by Howard Lee, Deputy Chief Executive,

Hong Kong Monetary Authority

In a fireside chat moderated by HKMA’s Lee, Ms. Skingsley expressed her passion about the relationship between central banks and innovation. She noted that central banks and local governments have a tight relationship, because domestic systems in different countries might be very diverse.

BIS Innovation Hub has been creating opportunities for central banks across the world to collaborate on providing future financial infrastructure and exploring ways to fit in with innovative technology.

The BIS Innovation Hub has high transparency with the reports and coding developed over the years and is hoping other institutions will learn and run their own experiments with them. It is also important for central banks to understand what technology is and how it can or cannot be used.

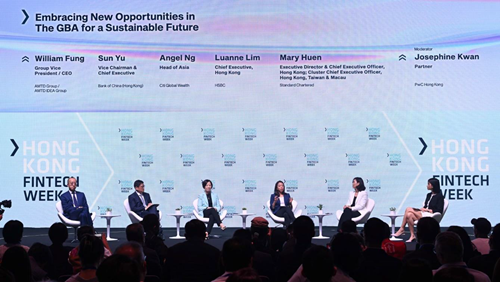

Embracing New Opportunities in The GBA for a Sustainable Future

Mary Huen, CEO, Standard Chartered Hong Kong;

William Fung, CEO, AMTD Idea Group;

Luanne Lim, CEO, HSBC Hong Kong;

Sun Yu Vice Chairman and Chief Executive, Bank of China Hong Kong;

Angel Ng, Head of Asia, Citi Global Wealth

– Panel moderated by Josephine Kwan, Partner, PwC

The leaders of major banks and financial services companies were asked about how and why they were integrating ESG into their financial decisions. From the start, Bank of China Hong Kong’s Yu, echoed the feelings of many of the panellists, “ESG is no longer just a concept or a slogan for companies to talk about. Now, it is turning into concrete business strategies.”

Meanwhile, Standard Chartered’s Huen: “Hong Kong’s great strength is in its role as a funder and advisor for companies everywhere—in China, the GBA, and internationally. In both capacities, we have the opportunity to direct our clients toward more sustainable options.”

ATMD Idea Group’s Fung, capped it off: “ESG is a way of life. It is not based on what you want, it is based on what we need. We all must do our part to make the world a better place for future generations.

Adrian Cheng: Hong Kong will dominate the development of cross-boundary blockchain infrastructure in the GBA

Adrian Cheng: Hong Kong will dominate the development of cross-boundary blockchain infrastructure in the GBA

Adrian Cheng, CEO of New World Development

Mr. Cheng expressed his support for the HKSAR Government’s latest policy statement on the development of virtual assets in Hong Kong. He said Hong Kong has a lot to offer in terms of digital assets, cryptocurrency, and blockchain. He also emphasised the importance of the China State Council’s support for blockchain.

“With our unique position in the Greater Bay Area, Hong Kong will dominate regional development of cross-border blockchain infrastructure, and blockchain ecosystem. Hong Kong is also at its best in guiding companies to navigate blockchain opportunities across Mainland China.”

“We also see opportunities in intertwining the physical with the digital dimension, which offers a new arena for innovators, and entrepreneurs to create shape and lead the next wave of cultural and artistic experiences. It’s a once in a lifetime opportunity for all of us – especially the younger generation, whose lives are already immersed in the web three world.”

Meta: Stepping Into APAC’s $1 trillion Metaverse

Dan Neary, Vice President, Meta APAC, Meta

Joining over video, Mr. Neary expressed his excitement over the incredible growth of the financial industry in Hong Kong and Asia Pacific, as well as Web3 technology and the Metaverse. Meta sees the Metaverse as the next evolution of the internet in social connection. The Metaverse is a digital connection that can be assessed by any device, anywhere, and with anyone. Mr. Neary said that the Metaverse is so much more immersive and has the power to change the world. For instance, our relationship with the internet has always been looking at the screen, but with the Metaverse, he believed that people will be living inside the internet, being a part of it.

Mr. Neary also mentioned that the Metaverse will feel different in three dimensions – the presence, persistence, and interoperability. A recent study revealed that the Metaverse has the potential to contribute $3 trillion to the global economy, and $1 trillion in Asian Pacific alone, by 2031. There is early usage of the Metaverse across different industries, some banks have launched VR apps, and some are using cryptocurrencies.

Andreessen Horowitz: Fintech’s Next Frontier

Alex Rampell, General Partner, Andreessen Horowitz

Andreesen Horowitz’s Rampbell said he sees a lot of opportunities for fintech companies to fill the little needs that consumers have. Just as Airbnb was created for users who wanted to borrow a home, and Uber was created for users who wanted to rideshare, fintech could fill many of the little gaps and needs in the life of the average financial customer.

When asked why this hadn’t happened yet, Alex said that it was a matter of a lot of fintech being new and not starting to fully digitise until the pandemic.

“HSBC and most other banks make their money off of inertia,” he said. “Just as an object in motion will stay in motion and an object at rest will stay at rest, so too will a customer at a bank stay at a bank even as the inconveniences pile up, unless they get a major push or disruption. At least in the US, a simple app that gets rid of many of the hassles of banking at any one institution or the other would make the lives of many customers so much easier.”

Top FinTech Investment and Trends

Jenny Lee, Managing Partner, GGV Capital;

Thomas G. Tsao, Founding Partner, Gobi Partners;

Jehan Chu, Co-Founder & Managing Partner, Kenetic

– Panel moderated by Samson Wong, Chief Investment Officer (Private Markets), Hong Kong Monetary Authority

In this session, Mr. Tsao told the audience to start looking south because Southeast Asia is a very large market, with mostly young and innovative individuals. He also mentioned that it was critical to focus on the China market as it has entered its third phase of development. “The GBA, especially Hong Kong, is very suitable for FinTech development,” he added.

Mr. Chu mentioned that blockchain is the next version of the internet. “Hybrid is the new catchphrase,” he added. He stated that going back to ‘Web 2.5’ is the key to success in blockchain and FinTech because that would make it more approachable to a wider public.

Meanwhile GGV Capital’s Lee said a company should be innovative and differentiate itself to the other FinTechs in Hong Kong to be successful. It is also important to be growing at manageable costs, with foreseeable and reachable ROI. “Simply put, you have to make sure to make money!” she said.

West Cap’s Tosi: Three fintech investments for the next decade

Laurence Tosi, Managing Partner & Founder, WestCap

– Fireside chat moderated by Christopher Hui, Secretary for

Financial Services and the Treasury, Hong Kong SAR

In a fireside chat moderated by Mr. Hui, WestCap’s Tosi named three key areas for fintech investments in the coming decade as payments, bank technologies, and access to the private market. He said that the companies that surprised him the most were those who were adaptive and continued to iterate over time.

He also gave advice to those who are considering starting their own businesses:

- Passion – do something you love. Sometimes it can be some personal problems that one is truly committed to

- Always be a learner – it’s important to know and learn about the happenings in the ecosystem

- Create a culture – Foster cultures where people can challenge their status quo and to be opened to new ideas

Mr. Hui also mentioned that the government is recruiting fintech talent from abroad to scale the talent base in Hong Kong, as well as to help people that are already in the field to enhance their knowledge levels.

HKMA & Bank of Israel: The Journey to a Retail CBDC

Nelson Chow, Chief Fintech Officer, Hong Hong Kong Monetary Authority;

Yoav Soffer, CBDC Project Manager, Bank of Israel

– Panel moderated by Daniel Eidan, Advisor, BIS Innovation Hub Centre Hong Kong

The HKMA is working with the Bank of Israel to create Central Banking Digital Currencies (CBDC). The idea behind them is to create a one-stop shop for digital payments.

“I recently got a new phone,” said Mr. Chow, “and I realised I had so many different payment apps on my phone.”

By creating CBDCs, the general public will find digital banking and transactions with merchants to be more accessible, since everything will be unified into one digital currency.

Hong Kong Heroes: Making Hong Kong Proud Again!

Maggie Ng, Head of Wealth & Personal Banking, Hong Kong, HSBC;

Vivienne Tam, International Fashion Designer and Founder, VIVIENNE TAM;

Simon Loong, Founder and Group CEO, WeLab

– Panel moderated by King Leung, Head of FinTech, InvestHK

While millennials and Generation Z are the primary movers and shakers of digitisation in the financial industry, they are not the only group banks need to think about, said Ms. Ng. The older groups of society might be slower to adopt these technologies, but they are equally important.

“We want to make sure we aren’t leaving anyone behind,” she added. “It’s very important to us to use digitisation to make things more accessible for everyone. If older groups who are slower to adopt the technology are left behind, then we haven’t made things more accessible to everyone, we’ve only shifted priorities toward the young.”

Global Leaders Series – The Economy of Tomorrow

Bill Winters, Group Chief Executive, Standard Chartered;

Daniel Pinto, President & COO, JPMorgan Chase

– Panel moderated by Yvonne Man, Anchor, Bloomberg

Moderated by Bloomberg’s Yvonne Man, Mr. Pinto and Mr. Winters talked about financial services and the structure across the banking sector. Mr. Pinto suggested that banks are adapting to technological developments, but there were still challenges for them, mainly with investments.

As for data, Mr. Pinto said that banks nowadays were trying to turn data into something useful for their businesses and customers. Banks could use data to segment clients and provide services or offerings for specific clients. On the other hand, Standard Chartered’s Winters said banks could not win in the game because there were many companies focused on data analyses. The market is always growing rapidly, Mr. Winters suggested banks teach their employees about the importance of data. It could be a key to win in the banking sector if they know how to use data wisely.

Other Announcement(s)

FINNOVASIA rebrands to Finoverse

FINNOVASIA, the appointed event organiser of the Hong Kong FinTech Week, announced its expansion into North America and the Middle East, along with a strategic partnership with a Bahamas regulator. The company also announced its rebranding to Finoverse as a testament to its global scale and pivot into Web3. Click here for more details.

About Invest Hong Kong

InvestHK is the department of the Hong Kong Special Administrative Region Government responsible for attracting foreign direct investment. It has set up a dedicated fintech team in Hong Kong to attract the world's top innovative fintech enterprises, start-up entrepreneurs, investors, and other stakeholders to set up and scale their business via Hong Kong into Mainland China, Asia, and beyond. For more information, please visit www.hongkong-fintech.hk.

Media Enquiries

Email: InvestHKteam@edelman.com

Adrianna Lau, Edelman

Tel: (852) 3756 8615

Bonita Wong, Edelman

Tel: (852) 2837 4758

- Tags